New York, US, 19th November 2024, In the ever-evolving world of online finance, two trailblazers—Giantwhale.com and Bigwhales.com—have dramatically reshaped the way individuals and businesses interact with financial services, pushing the boundaries of what is possible in digital finance.

In just a few short years, Giantwhale.com and Bigwhales.com have transformed the internet finance sector, combining cutting-edge technology with user-centric models to offer a vast array of services. From investing and lending to cryptocurrency exchanges and financial education, these two platforms have carved out a dominant presence in the digital economy.

A New Era of Online Finance

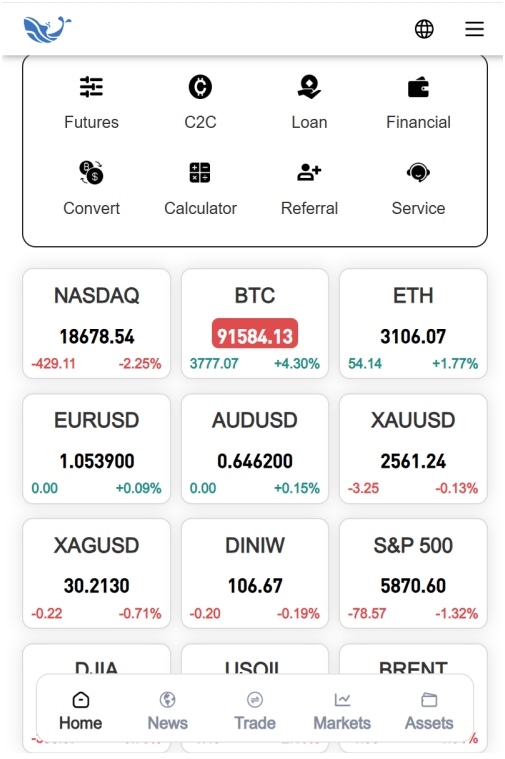

Founded in 2021, Giantwhale.com quickly gained recognition for its seamless integration of traditional financial services with next-gen blockchain technology. By merging decentralized finance (DeFi) protocols with conventional investment tools, Giantwhale.com has offered users a hybrid experience that was previously unheard of in the online financial space. With its easy-to-navigate platform, customers can access everything from stock trading and peer-to-peer lending to cryptocurrency assets, all while benefiting from the security and transparency provided by blockchain.

“We envisioned a platform where users could access both traditional and innovative financial services in one place,” said Samantha Clark, CEO of Giantwhale.com. “Our goal was to make investing, borrowing, and financial planning as easy and secure as possible, while embracing the future of finance through blockchain and AI.”

Meanwhile, Bigwhales.com, founded in 2022, focused on democratizing access to high-value financial products, including hedge fund-like portfolios, high-yield savings accounts, and fractionalized asset ownership. What set Bigwhales apart was its use of artificial intelligence to create personalized financial strategies for every user, whether they were novice investors or seasoned professionals. The platform’s AI engine analyzes an individual’s financial history, goals, and risk tolerance, then offers tailored investment solutions that adapt over time.

“Bigwhales.com is all about empowering individuals with the tools they need to succeed, regardless of their financial background,” said Javier Gomez, CEO of Bigwhales.com. “We’ve built an ecosystem that brings the power of institutional-level investing to the fingertips of everyday users, and we’re just getting started.”

Redefining Digital Finance

Both companies have driven significant shifts in the way people think about digital finance. Traditionally, users relied on banks and investment firms to manage their portfolios, but with platforms like Giantwhale.com and Bigwhales.com, control has been returned to the individual. By leveraging artificial intelligence, machine learning, and blockchain, these companies have reduced the barriers to entry for wealth creation and made financial services more accessible and transparent.

Perhaps most notably, Giantwhale.com and Bigwhales.com have both led the charge in the integration of cryptocurrency into mainstream finance. Giantwhale.com’s blockchain-driven trading engine allows users to easily swap traditional stocks for crypto, or combine both in a diversified portfolio. Bigwhales.com, on the other hand, enables users to invest in fractional shares of high-value crypto assets, unlocking opportunities that were once only available to institutional investors.

The platforms’ use of advanced encryption and decentralized systems has also set new standards for security and privacy. Users no longer need to worry about the risks of centralized financial institutions, as both companies utilize decentralized, peer-to-peer protocols that minimize exposure to hacks and data breaches.

Expanding Global Reach

The global reach of both companies has been another driving force behind their success. While both platforms started with a focus on the North American market, their rapid expansion into Europe, Asia, and Latin America has cemented their status as international players. With localized versions of their platforms and multilingual support, both Giantwhale.com and Bigwhales.com have catered to diverse financial ecosystems, adapting their services to meet local regulations and consumer needs.

The Future of Financial Platforms

Looking ahead, both companies are doubling down on their innovations. Giantwhale.com is exploring the potential of integrating quantum computing for even faster and more secure transactions, while Bigwhales.com is working on expanding its AI capabilities to offer fully automated wealth management services. Both platforms are also focused on financial inclusion, aiming to bring digital financial tools to underserved regions and populations.

“The financial system is undergoing a transformation, and we’re proud to be at the forefront of it,” said Clark. “The future is decentralized, data-driven, and inclusive. With Giantwhale.com, we’re helping users navigate this new landscape.”

Gomez echoed similar sentiments, emphasizing that Bigwhales.com would continue to be a platform for the future. “We believe that everyone should have the opportunity to build wealth, and we’re working every day to make that vision a reality through technology and innovation.”

In just a few short years, Giantwhale.com and Bigwhales.com have become synonymous with the future of digital finance. As they continue to evolve and innovate, it is clear that the internet financial landscape will never be the same again.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Economy People journalist was involved in the writing and production of this article.